Description

Although more than 6,000 U.S. companies have an employee stock ownership plan (ESOP), many businesspeople are not well acquainted with them. ESOPs are often confused with stock option plans, which are something else altogether. They are not stock purchase plans; employees almost never buy stock through an ESOP. They do not require that employees run the company or even elect the board unless companies want to structure themselves that way. Most people, in fact, would be well served by forgetting what they have heard or thought about ESOPs before starting to learn more about them. This book will teach you what ESOPs really are, how they work in both C and S corporations, what their uses are, what the valuation and financing issues are, what the steps to set them up are, and much more.

In the second edition (2024), there are four new chapters: an introductory chapter with color graphics providing a visual introduction to ESOPs, a chapter on governance, a chapter on simpler ESOP structures, and a final chapter on alternatives to ESOPs such as employee ownership trusts (EOTs). The remaining chapters have been updated where needed.

Product Details

Table of Contents

Preface

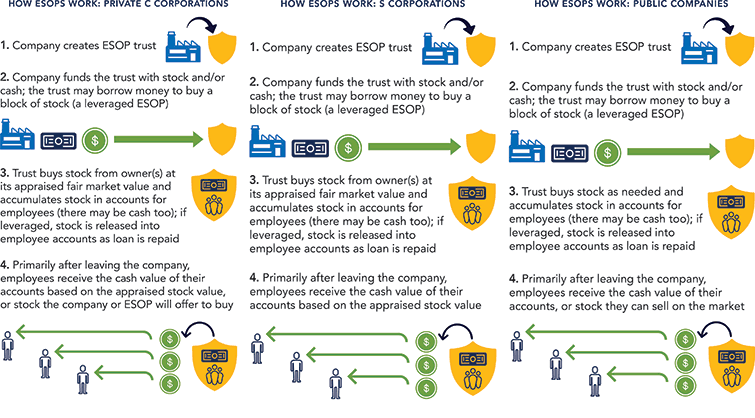

1. A Visual Introduction to ESOPs

2. An Overview of How ESOPs Work

3. Selling to an ESOP in a Closely Held Company

4. ESOPs in S Corporations

5. Understanding ESOP Valuation

6. Things to Do with an ESOP Besides Buying Out the Owner

7. Financing an ESOP

8. ESOP Distribution and Diversification Rules

9. Choosing Consultants and Trustees

10. Corporate Performance and Ownership Culture

11. ESOP Governance

12. Simpler ESOP Structures

13. Alternatives to Using an ESOP for Employee Ownership

About the Authors

About the NCEO

Excerpts

From chapter 1, "A Visual Introduction to ESOPs"

From chapter 2, "An Overview of How ESOPs Work"

As noted above, in creating an ESOP, a company sets up an employee benefit trust, which it funds by contributing cash to buy company stock, contributing shares directly, or having the trust borrow money to buy stock, with the company making contributions to the plan to enable it to repay the loan. Generally, at least all full-time employees with a year or more of service are in the plan. To ensure these rules are met, the board appoints a trustee to act as the plan fiduciary. Some ESOP company boards appoint an ESOP fiduciary committee, usually made up of insiders but occasionally with outsiders as well, to make decisions for the plan and instruct the formal trustee on how to act. The trustee can be anyone, although larger companies tend to appoint outside trust institutions, while smaller companies typically appoint managers or create ESOP trust committees. ESOPs are designed to invest primarily in the stock of the employer and can buy treasury shares, newly issued shares, or shares from exiting owners.

There is one very important point that is widely misunderstood: employees almost never contribute to the plan; instead, contributions are funded by the company as a benefit, and shares are allocated to employee accounts on a nondiscriminatory basis, much as in a profit-sharing plan. It’s worth repeating that: as a rule, employees do not buy shares in an ESOP. Over the years, we at the NCEO have found that many people considering an ESOP have a difficult time understanding how that can be. The answer is simple: the company funds the plan instead.

From chapter 5, "Understanding ESOP Valuation"

In the past, the decision on whether a valuation firm that has done work for the firm before the ESOP could be hired by the trustee was a matter of disagreement, but that has changed. The DOL has been very clear on this issue in recent years and is very skeptical of appraisers who have any other relationship with the company. Appraisal firms that have done work unrelated to the ESOP should be excluded. A more difficult issue is whether an appraisal firm that is hired to do a preliminary appraisal for ESOP purposes can be used for the full-scale ESOP appraisal for the ESOP transaction. A preliminary appraisal can help a company decide whether to do an ESOP and to plan for financing it. Tim Hauser, a deputy assistant secretary at the DOL, has argued that this is “road testing” the appraiser to see if a high enough price can be obtained, and he says the DOL wants companies to use a different firm for the transaction than for the preliminary appraisal, one hired by the trustee. Using a separate firm adds somewhat to the cost, but it also means the preliminary appraisal may come to a somewhat different conclusion of value than would be obtained from the firm that will ultimately do the ESOP appraisal, albeit the difference is likely to be small. Given the litigation and/or DOL investigation risks of using an appraiser who has done work for the company or the seller and the fact that ESOP valuation professionals usually come to very similar conclusions of value, we strongly recommend that the ESOP appraisal firm have no other existing or prior relationship with the seller or the company.

From chapter 11, "ESOP Governance"

Trustees are appointed by the board and, in turn, vote the shares in the plan for board elections. In theory, trustees could try to throw out the board or at least elect a new majority, and the board could retaliate by firing the trustee. In practice, this scenario has only come up a few times in the almost 50 years since ESOPs gained a statutory basis in ERISA. Trustees rarely propose specific people for boards but increasingly require that the board have at least some outside board members. About 75% of ESOP companies have outside, independent board members.

The DOL and most ESOP advisors (and the NCEO) strongly recommend that there be an independent, outside trustee for any transactions between the ESOP and a seller to the ESOP or a buyer of the company. While a company can designate one or more employees as trustees for these transactions, the potential conflict of interest can be problematic if the sale is contested. Outside trustees also bring expertise that insiders lack in negotiating terms that work for buyers, sellers, and the DOL.