Employee Ownership by the Numbers

Counts and characteristics of ESOPs and other employee stock ownership plans in the U.S., drawn on data made available by the U.S. Department of Labor and other sources.

Page Contents

How Many ESOPs Are There?

In 2022, the most recent year for which data is available, 292 new ESOPs were created, adding 31,616 active participants.

In total, there are 6,548 ESOPs in the United States, holding total assets of over $1.8 trillion. The number of unique companies with an ESOP is approximately 6,358 (5,925 private companies and 433 publicly traded companies). A company may sponsor multiple plans.

A note on the timing of the data: The DOL’s data is sourced from Form 5500 retirement plan filings, which are due seven months after the end of each plan year, or nine and a half months if an extension is requested. The DOL takes up to a year to process and clean the data once received, and the NCEO does additional supplementation and analysis of the data after the public release. As a result, there is typically a time lag of up to two years. The benefit of the DOL's long process is that the data is comprehensive and reflects close to perfect coverage of every ESOP (and every other retirement plan) in the U.S.

How Many Workers Are in ESOPs?

ESOPs cover 14.9 million participants, of whom over 10.8 million are active participants—those currently employed and covered by an ESOP.

| Category | Plans | Total Participants | Active Participants | Employer Securities (millions) | Total Plan Assets (millions) |

|---|---|---|---|---|---|

| Privately held companies | 6,016 | 2,620,779 | 1,939,226 | $209,681 | $301,750 |

| Small plans (under 100 participants) | 3,407 | 153,107 | 113,296 | $20,203 | $23,399 |

| Large plans (100+ participants) | 2,609 | 2,467,672 | 1,825,930 | $189,478 | $278,351 |

| Publicly traded companies | 533 | 12,335,536 | 8,924,849 | $150,916 | $1,516,906 |

| Total | 6,548 | 14,956,315 | 10,864,075 | $360,597 | $1,818,656 |

Contributions and Distributions

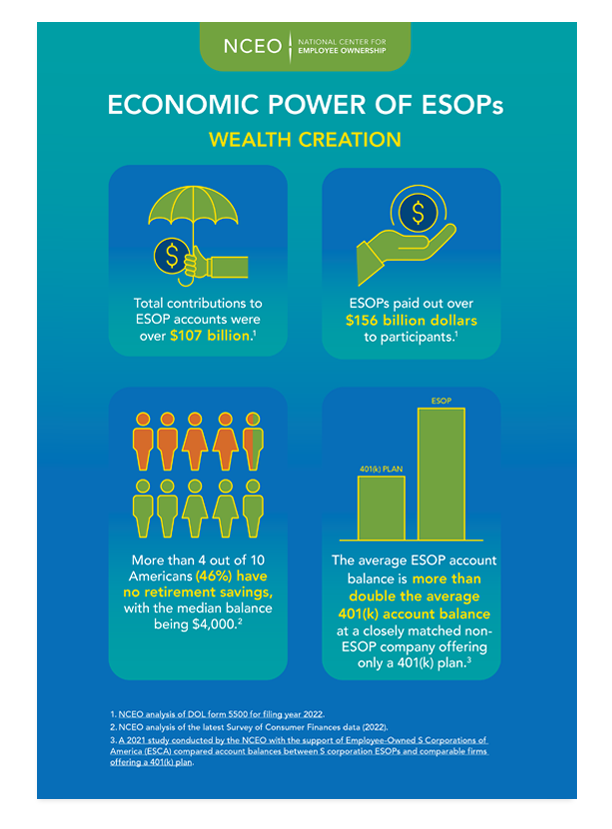

ESOPs paid out over $156 billion dollars to participants in 2022. Total contributions to ESOP accounts were over $107 billion in 2022.

| Name | ESOP contributions (millions) | ESOP benefits paid (millions) |

|---|---|---|

| Privately held companies | $13,149 | $24,765 |

| Publicly traded companies | $94,473 | $131,392 |

| Total in 2022 | $107,623 | $156,158 |

These numbers are sourced from the NCEO's analysis of the Private Pension Plan (PPP) Research Files made available by the Department of Labor from data reported on the Form 5500. The PPP file is created each year by the Employee Benefits Security Administration's (EBSA) Office of Policy and Research (OPR) at the DOL and is used to generate and analyze aggregate statistics on the characteristics of the private pension plan universe. Direct Filing Entities (DFEs), welfare plans, one-participant plans, public retirement plans, and duplicate filings of other retirement plans are excluded from the Research File. NCEO methodology follows DOL standard practices with any exceptions noted.

Definitions of ESOPs are based on the plan characteristic codes filled in by the sponsor on line 8 of the form, or these codes were added as a result of the DOL's cleaning and editing of the data: 2O ("ESOP other than a leveraged ESOP") or 2P ("Leveraged ESOP—An ESOP that acquires employer securities with borrowed money or other debt-financing techniques"). Unlike the DOL, however, our count also includes plans without the 2O or 2P codes but with the code 2Q ("The employer maintaining this ESOP is an S corporation").

Large plans are defined as plans with 100 or more total participants and small plans as plans with fewer than 100 participants.

Publicly traded companies are identified by the NCEO through exhaustive research and web searches. Companies are classified as public if their stock is traded on the NYSE, NASDAQ, or AMEX exchanges.

Active participants include any workers currently in employment covered by a plan and who are earning or retaining credited service under a plan.

Total asset amounts shown do not include the value of allocated insurance contracts of the type described in 29 CFR 2520, 104-44.

What Kinds of Companies Have ESOPs?

ESOPs are represented across a wide variety of industries, with a plurality of plans in manufacturing or professional services:

Figure 1: Industries of ESOP Companies

For more details about ESOPs in each industry, see our ESOP Industry Fact Sheets.

S vs. C Corporations

A majority (66%) of privately held ESOPs are in S corporations:

| Name | Plans | Total participants | Active participants | Employer securities (millions) | Total plan assets (millions) |

|---|---|---|---|---|---|

| S Corporations | 3,983 | 1,121,971 | 784,533 | $158,689 | $180,609 |

| C Corporations | 2,033 | 1,498,808 | 1,154,694 | $50,992 | $121,141 |

Leveraged and Non-leveraged ESOPs

The sale of company stock to an ESOP is commonly financed with one or more loans. ESOPs financed this way are termed leveraged ESOPs. A little under two-thirds (58%) of privately held ESOPs are currently leveraged, as described in table 4 below. Note that some plans that are currently non-leveraged may have been leveraged initially.

| Name | Plans | Total participants | Active participants | Employer securities (millions) | Total plan assets (millions) |

|---|---|---|---|---|---|

| Leveraged ESOPs | 3,466 | 866,155 | 618,276 | $106,170 | $124,362 |

| Non-leveraged ESOPs | 2,467 | 1,720,005 | 1,300,121 | $99,924 | $170,825 |

Note: We classify an ESOP as leveraged if the plan's Form 5500 filing uses the pension benefit code 2P, "An ESOP that acquires employer securities with borrowed money or other debt-financing techniques."

Where Are ESOPs Located?

The map below shows the number of ESOPs and total participants in each state. Hover over a state for details.

For more details about ESOPs in each state, see our State ESOP Fact Sheets.

For a full nationwide list of all ESOPs containing detailed information on each plan, see our ESOP database.

How is the ESOP Universe Changing Over Time?

The below tables and figure show the change in total ESOPs and total and active participants over time from 2014 to 2022.

| Filing Year | Number of ESOPs | Total Participants, Millions | Active Participants, Millions |

|---|---|---|---|

| 2014 | 6,718 | 14.05 | 10.56 |

| 2015 | 6,669 | 14.43 | 10.82 |

| 2016 | 6,625 | 14.20 | 10.61 |

| 2017 | 6,561 | 14.24 | 10.61 |

| 2018 | 6,502 | 14.05 | 10.37 |

| 2019 | 6,482 | 13.90 | 10.21 |

| 2020 | 6,467 | 13.95 | 10.17 |

| 2021 | 6,533 | 14.74 | 10.70 |

| 2022 | 6,548 | 14.96 | 10.86 |

| Filing Year | Privately Held ESOPs | Publicly Held ESOPs |

|---|---|---|

| 2014 | 6,130 | 588 |

| 2015 | 6,067 | 602 |

| 2016 | 6,000 | 625 |

| 2017 | 5,928 | 633 |

| 2018 | 5,860 | 642 |

| 2019 | 5,880 | 602 |

| 2020 | 5,887 | 580 |

| 2021 | 5,973 | 560 |

| 2022 | 6,016 | 533 |

Figure 2: Active Participants in Public and Privately Held ESOPs, 2014-2022

New ESOP Creation

Since 2016, an average of 264 new ESOPs have been created each year. The below chart shows new ESOP creation since 2016.

Figure 3: New ESOP Creation, 2016-2022

Other Forms of Employee Stock Ownership in the U.S.

There are 5,051 profit-sharing, stock bonus, or other defined contribution plans that are not ESOPs but are substantially (at least 20%) invested in employer stock. These plans cover 842,126 active participants. The number of these plans has been steadily rising, as shown in Table 7:

| Filing Year | Number of ESOP-like plans |

|---|---|

| 2010 | 1,676 |

| 2011 | 1,985 |

| 2012 | 2,231 |

| 2013 | 2,528 |

| 2014 | 2,898 |

| 2015 | 3,241 |

| 2016 | 3,773 |

| 2017 | 4,075 |

| 2018 | 4,468 |

| 2019 | 4,680 |

| 2020 | 4,866 |

| 2021 | 4,926 |

| 2022 | 5,051 |

It is not possible to determine if other forms of stock ownership are broad-based as ESOPs are required to be.

According to the most recently available data from 2022, about 58 percent of families owned stocks: 34 percent of families in the bottom half of the income distribution held stocks, whereas about 78 percent of families in the upper-middle-income group held stock, and more than 95 percent of families in the top decile held stock. In addition to these differences across income groups in stock market participation rates, there are significant differences in the value of stock market holdings, conditional on holding stock. In 2022, the conditional median value of stock holdings for the bottom half of the income distribution was about $12,600, compared with $53,200 for the upper-middle-income group and nearly $608,000 for the top income decile.

The Survey of Consumer Finances (SCF) is a triennial cross-sectional survey of U.S. families. The survey data include information on families’ balance sheets, pensions, income, and demographic characteristics. This survey reports on direct and indirect holdings of publicly traded stock.

Employee Stock Purchase Plans (ESPPs) typically provide an opportunity for employees to periodically purchase discounted company shares using payroll deductions. In April 2020, Aon reported that 49% of S&P 500 companies and 38% of Russell 3000 companies offer an ESPP to their employees.

Worker Cooperatives

Worker cooperatives are businesses owned and governed by their employees. Member employees govern the business, share its profits, and make decisions democratically on a one-member, one-vote basis. Worker cooperatives are less common than other forms of employee ownership. According to the State of the Sector report by the Democracy at Work Institute (DAWI), there are at least 751 worker cooperatives, an increase of 20% over the last two years.

Download Resources and Graphics

For more details about ESOPs in each industry and state, see our State and Industry ESOP Fact Sheets.

For a full nationwide list of all ESOPs containing detailed information on each plan, see our ESOP database.

Contact us at research@nceo.org with any questions about how to make this data useful to your company.

Research on Employee Ownership and the Economy

An extensive research literature explores how employee ownership affects the economic fortunes of workers, companies, and communities. Read our summary here.

For questions about this or any of our research, contact the NCEO's Research Director Nancy Wiefek at nwiefek@nceo.org / 510-208-1312